Browsing Insurance Insurance Claims: The Function of Independent Adjuster Firms

Wiki Article

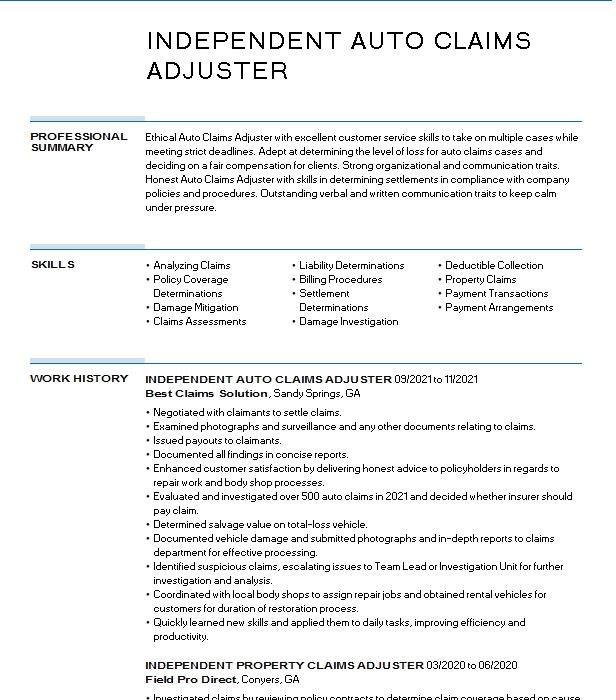

The Ultimate Profession Course for Independent Adjusters in the Insurance Industry

Browsing the detailed web of opportunities within the insurance policy market can be a difficult yet satisfying journey for independent insurance adjusters looking for to sculpt out an effective occupation path. From refining necessary abilities to going after innovative accreditations, the supreme job trajectory for independent insurance adjusters is a diverse terrain that demands tactical planning and continual development.Recognizing the Insurance Sector Landscape

Recognizing the insurance policy industry landscape is vital for independent insurers to browse the intricacies of this market successfully and effectively. Independent insurers must have an extensive understanding of the various kinds of insurance policy plans, insurance coverage restrictions, laws, and market trends to excel in their duties.Moreover, a deep understanding of the insurance industry landscape enables independent adjusters to build solid relationships with insurer, insurance policy holders, and other stakeholders. By having a strong grasp of how the market operates, independent insurers can successfully negotiate negotiations, solve disputes, and supporter for reasonable case outcomes. On the whole, a detailed understanding of the insurance market landscape is a fundamental aspect for success in the area of independent adjusting.

Establishing Necessary Skills and Experience

Furthermore, a solid grasp of insurance policy regulations and policies is necessary. Adjusters should remain current with industry legislations, requirements, and standards to guarantee compliance and supply exact advice to clients - independent adjuster firms. Additionally, analytical abilities are essential for independent insurers who typically run into tough circumstances that need fast thinking and cutting-edge services to meet client needs

Continual understanding and professional growth are key to remaining competitive in this field. By refining these necessary abilities and proficiency, independent insurance adjusters can construct effective careers in the insurance policy sector.

Structure a Strong Professional Network

Establishing durable connections within the insurance coverage sector is vital for independent insurers looking to advance their occupations and increase their chances. A strong specialist network can give beneficial support, insights, and cooperation possibilities that can improve an insurer's abilities and online reputation within the industry. Building partnerships with insurance carriers, claims managers, fellow insurers, and various other industry specialists can open up doors to brand-new jobs, mentorship possibilities, and prospective references. Going to industry seminars, networking events, and engaging with associates on specialist systems like LinkedIn can help independent adjusters broaden their network and stay updated on discover this sector fads and ideal techniques.Additionally, networking can also bring about partnerships and cooperations with other experts in relevant areas such as insurance policy lawyers, professionals, and representatives, which can better boost an adjuster's ability to offer detailed and effective insurance claims services. By proactively purchasing building and maintaining a solid specialist network, independent adjusters can place themselves for lasting success and growth in the insurance coverage market.

Advancing to Specialized Insurance Adjuster Functions

Transitioning to specialized insurance adjuster duties calls for a deep understanding of particular niche areas within the insurance coverage industry and a commitment to continual knowing and specialist advancement. Specialized adjuster functions offer possibilities to concentrate on specific sorts of claims, such as home damage, bodily injury, or employees' compensation (independent adjuster firms). These duties demand a higher level of experience and usually need extra certifications check or specialized trainingTo progress to specialized adjuster settings, people ought to take into consideration pursuing industry-specific qualifications like the Chartered Property Casualty Underwriter (CPCU) or the Associate in Claims (AIC) designation. These credentials demonstrate a commitment to understanding the ins and outs of a specific area within the insurance coverage field.

Additionally, obtaining experience in taking care of complex cases and expanding knowledge of relevant legislations and regulations can enhance the opportunities of transitioning to specialized roles. Building a strong professional network and seeking mentorship from experienced insurers in the wanted niche can also supply important understandings and open doors to development opportunities in specialized adjuster settings. By continually sharpening their skills and remaining abreast of industry fads, independent insurers can position themselves for an effective career in specialized functions within the insurance coverage sector.

Achieving Expert Certifications and Accreditations

Gaining professional qualifications and accreditations in the insurance coverage field represents a dedication to customized know-how and recurring specialist development past typical adjuster duties. These qualifications verify an insurance adjuster's understanding and skills, setting them apart in an affordable market.

Final Thought

To conclude, independent adjusters in the insurance sector can attain profession success by understanding the sector landscape, establishing essential abilities, constructing a strong professional network, advancing to specialized duties, and getting expert accreditations. By complying with these actions, adjusters can enhance their know-how and credibility in the field, eventually bring about raised opportunities for advancement and success in their careers.Furthermore, a deep understanding of the insurance coverage market landscape allows independent adjusters to develop solid connections with insurance coverage business, insurance policy holders, and other stakeholders. Developing a strong professional network and seeking mentorship from experienced insurers in the desired specific niche can also give open doors and valuable insights to improvement chances in specialized insurance adjuster settings. By continuously refining their skills and staying abreast of industry fads, independent adjusters can position themselves for an effective job in specialized functions within the insurance coverage field.

In addition, insurance adjusters can go after accreditations certain to their field of interest, such as the Qualified Disaster Risk Management Professional (CCRMP) for disaster insurers or the Certified Automobile Appraiser (CAA) for vehicle insurance claims professionals. By getting expert certifications and certifications, independent insurance adjusters can expand their occupation opportunities and show their commitment to excellence in the insurance industry.

Report this wiki page